Real estate investment without hedging

HOW do I invest in the Vienna real estate market with Bulldog Real Estates?

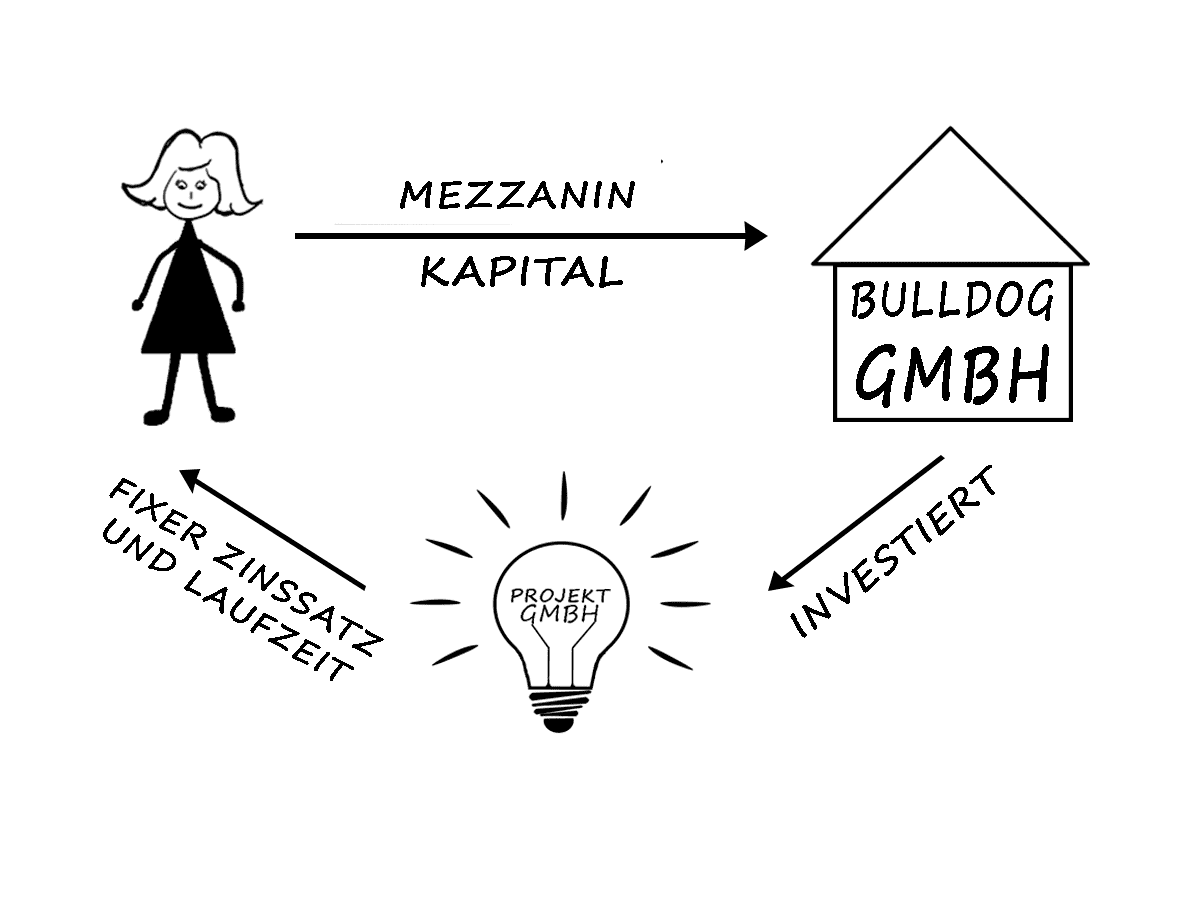

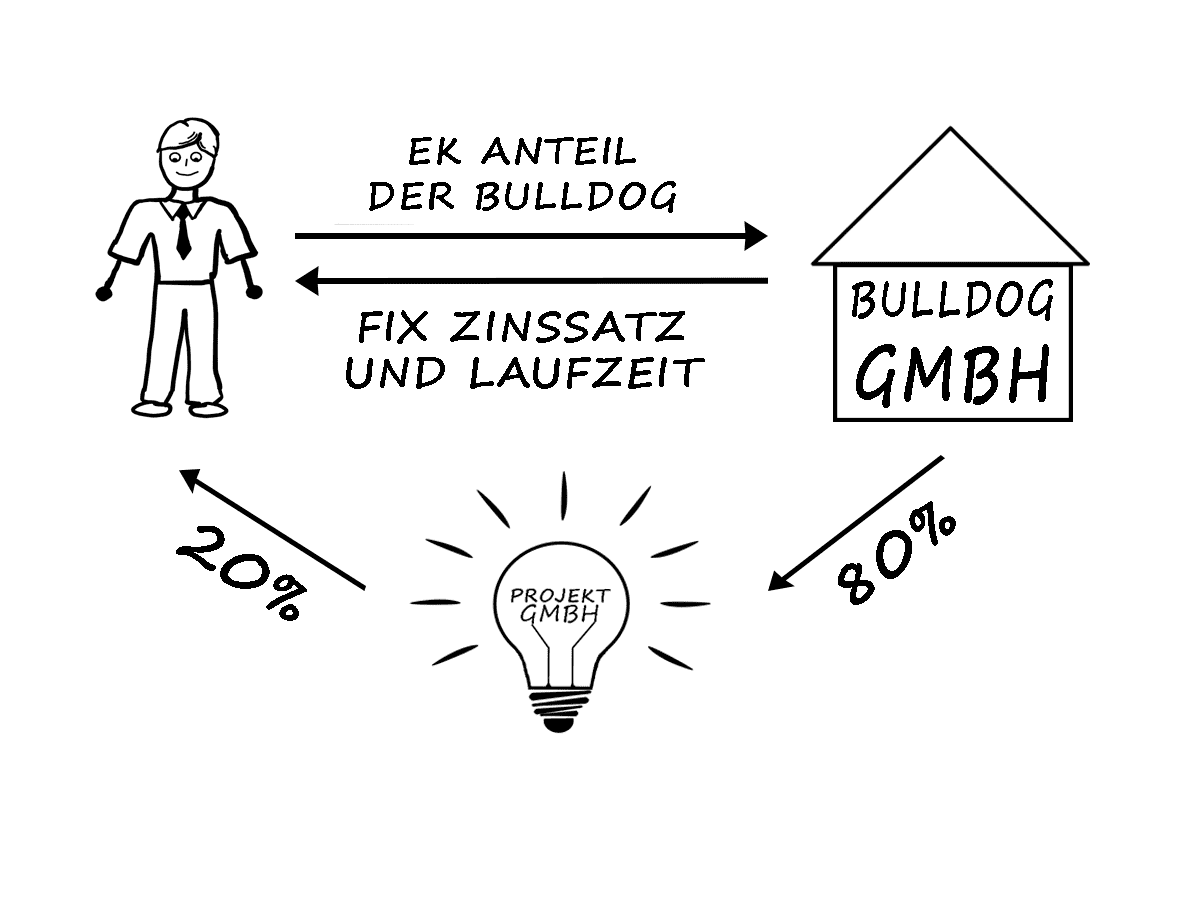

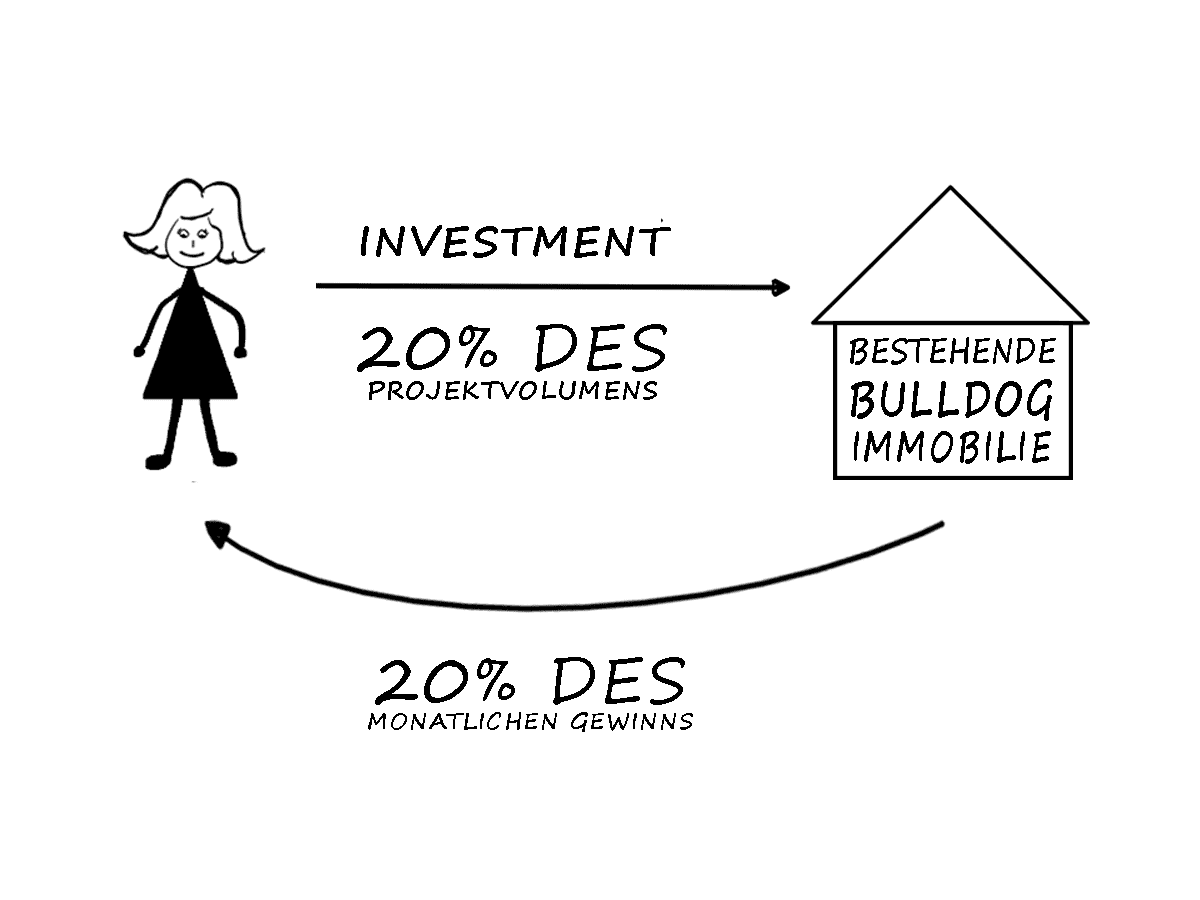

You are making your real estate investment in a future project, i.e. an apartment or a house.

We use the money to buy or rent a new property and you will receive a fixed interest rate.

Your money is tied up in the property. The assessment period ranges from 6 months to 10 years.

Numerical example: You invest 40,000 € at an interest rate of 8% - you receive 8% as an annual distribution.

Your annual income: 3,200 €

Advantage - high return, no option contract.

- Yield: 5% - 8% p.a.

- Duration: 6 - 120 months

- Distribution: Variable

- Repayment: Individual

- Protection: less than 50,000 €, without option contract *

* Option contract: A property is deposited as security. Should Bulldog Real Estate fail to repay the loan, the option holder can incorporate the deposited real estate.

WHY should you invest your money in real estate with us and HOW can you make a real estate investment with us?

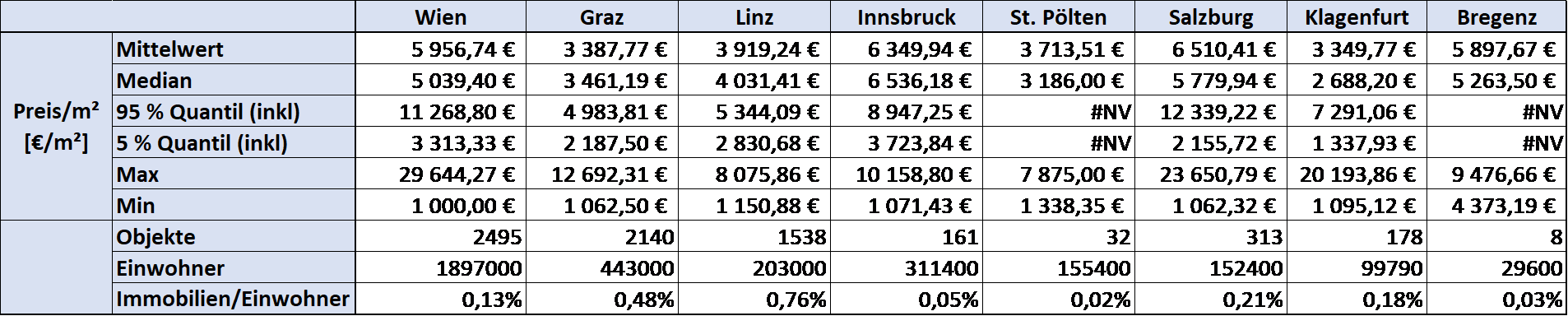

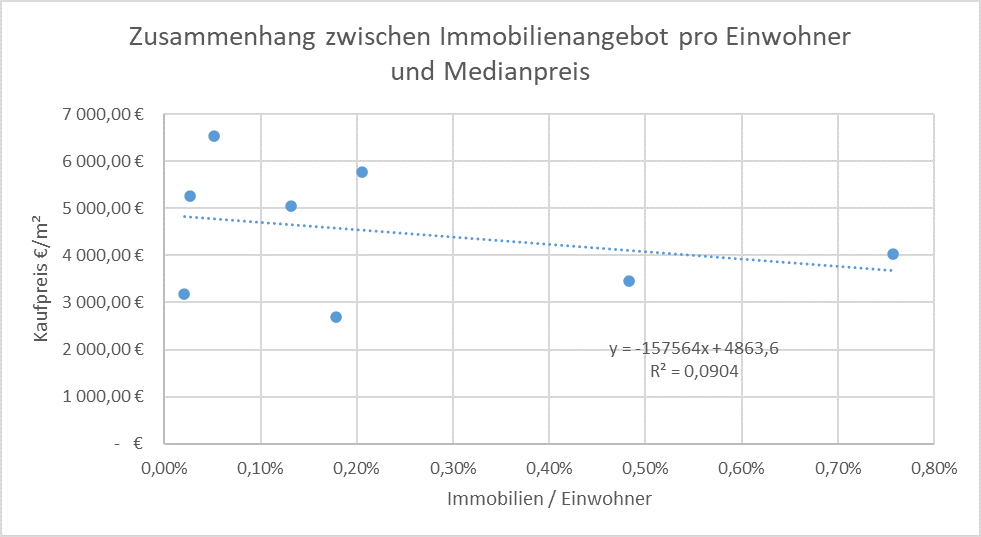

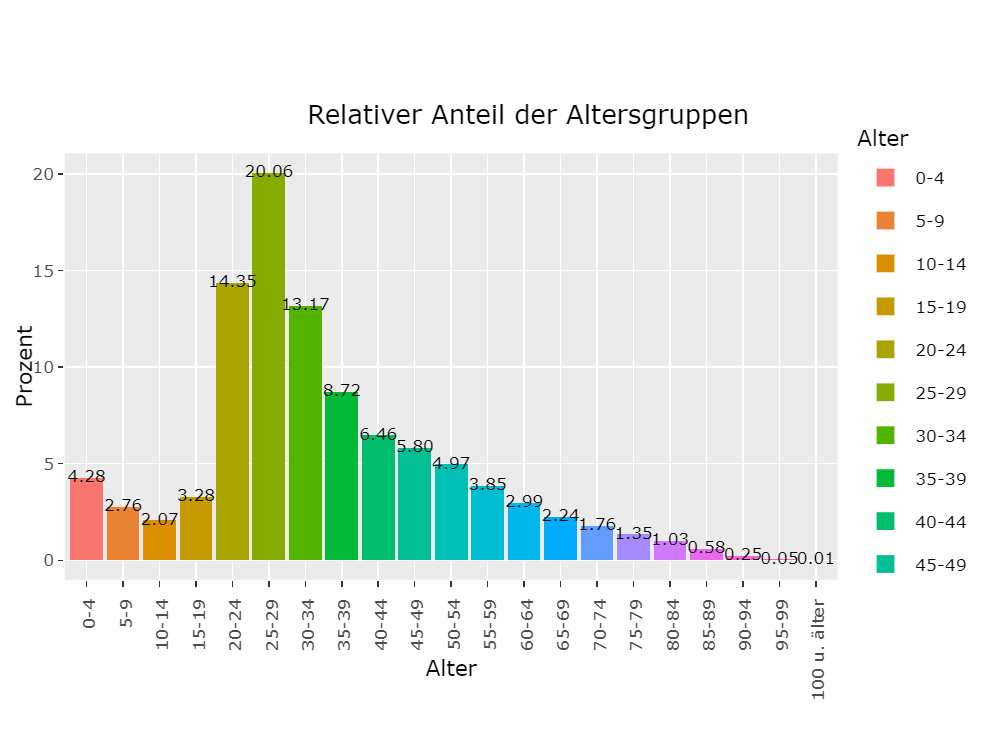

Let's now clarify the WHY - Our concept works! With our type of rental,

room renting to young professionals and students, we can still reach a reasonable return on the Viennese housing market

and compensate for the increased costs of crowdfunding in order to reward our private financiers safely and fairly.

What do we do with the money?

We make real estate investments in Vienna! Only inner city locations and below market value!

For a investment with Bulldog Real Estate send us a message.

You will then receive a specific proposal.